Impact of a Strengthening Dollar on Crypto Markets

In December 2024, Bitcoin traders set their sights on an $80,000 price target as the U.S. Dollar Index (DXY) reached a new high of 109.37. The strengthening dollar has sparked debate over whether it could exert additional pressure on cryptocurrency markets.

The recent uptick in the DXY is attributed to rising U.S. Treasury yields, with the 10-year and 30-year yields climbing to 4.7% and 4.93%, respectively. Analysts suggest this reflects market concerns that the fiscal policies of incoming U.S. President Donald Trump could lead to higher inflation.

Challenges Facing Bitcoin’s Price Movement

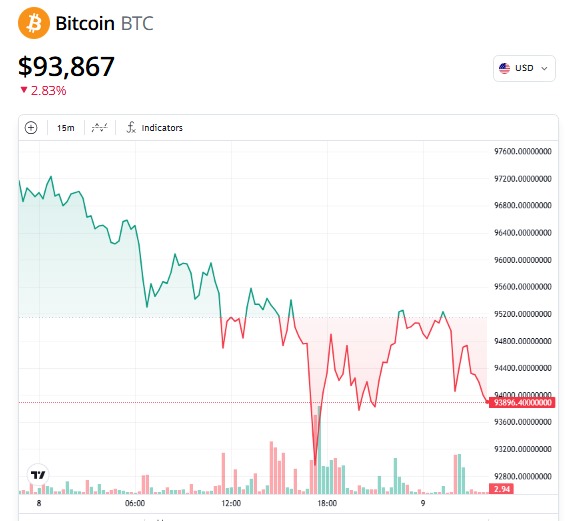

Bitcoin’s price has shown signs of retracement amid the dollar's rally, recently hitting an intra-day low of $92,500. Analysts caution that a drop below the $90,000 support level could trigger further declines in the near term.

Market watchers believe that Bitcoin must hold above $95,000 to maintain its momentum toward the $80,000 target. Some experts predict that Bitcoin may only regain its upward trajectory if the DXY undergoes a correction.

Market Expectations and Future Outlook

Crypto market analysts suggest that Bitcoin's price movements in the short term will likely hinge on macroeconomic factors, including Federal Reserve policy signals and inflation expectations. While some traders anticipate Bitcoin testing the $81,000 support zone in the coming weeks, others remain cautious, citing volatility as a key hurdle.