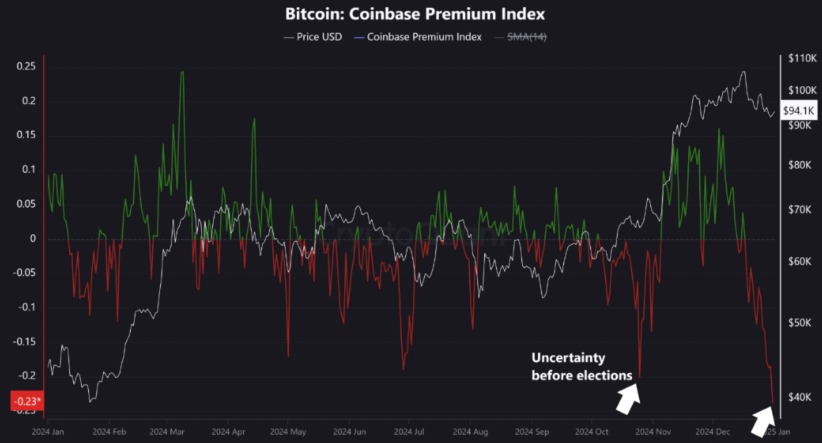

At the end of 2024, Bitcoin's (BTC) Coinbase Premium Index fell to its lowest level in 12 months, potentially challenging short-term price recovery.

Decline in Coinbase Premium Index

The Coinbase Premium Index measures U.S. retail investor demand for Bitcoin.An increasing index indicates rising buying pressure, while a negative value suggests growing selling pressure.On December 31, the index dropped to -0.23, its lowest point since January 2024.On the same day, Bitcoin briefly fell to $91,479, its lowest level since November 27.

Impact of Low-Liquidity Market

Analyst Burakkesmeci noted that increased selling pressure in the U.S. market led to the decline in the Coinbase Premium Index.He attributed this to a low-liquidity market at year-end.The last similar level occurred in January 2024, coinciding with the launch of spot Bitcoin exchange-traded funds (ETFs) in the U.S.In late October, before the U.S. elections, the index approached -0.20 when Bitcoin was trading around $68,165.

Challenges to Short-Term Price Recovery

Burakkesmeci warned that without changes in macroeconomic conditions or a surge in interest from institutional or retail buyers, Bitcoin's short-term price recovery might face challenges.A key macroeconomic event the crypto industry is watching is President-elect Donald Trump's inauguration on January 20.Some analysts believe Bitcoin's rally may continue post-inauguration after an initial stall.Ryan Lee, chief analyst at Bitget Research, suggested that Bitcoin's price could experience a correction of up to 30% before resuming its bullish trend.

Profits Among Long-Term Holders

Meanwhile, long-term Bitcoin holders—those holding for over 155 days—are currently seeing significant profits.This could increase the risk of further sell-offs as investors might look to cash in profits before the new year.According to Bitbo, the realized price for long-term holders is $24,298, representing approximately a 290% profit margin if sold at the current price of $94,820.However, short-term holders (holding less than 155 days) have a significantly higher average cost basis of $86,753, yielding only about a 9.29% profit if sold at the current price.