Artificial intelligence firm Genius Group Limited saw a sharp 66% rise in its stock value after announcing a new “Bitcoin-first” treasury strategy, positioning Bitcoin as its primary treasury asset and closely mirroring the strategy used by MicroStrategy.

The company plans to allocate 90% or more of its current and future reserves to Bitcoin, starting with a $150 million at-the-market (ATM) offering to reach an initial goal of $120 million in Bitcoin holdings. Additionally, Genius Group announced on November 12 that it will enable Bitcoin payments on its educational platform and introduce a Web3 learning series aimed at educating students about Bitcoin and cryptocurrencies.

On November 12, Genius Group’s (GNS) shares closed up 66.4% at $1.05 and continued climbing to $1.71 in after-hours trading, showing an additional 62.86% increase, as per Google Finance.

Thomas Power, a Genius Group director, commented, “We are inspired by Michael Saylor and MicroStrategy’s approach to using Bitcoin as a primary treasury reserve asset, and we fully endorse this strategy. We believe our ‘Bitcoin-first’ approach will make us one of the first NYSE American-listed companies to adopt this Bitcoin strategy for the benefit of our shareholders.”

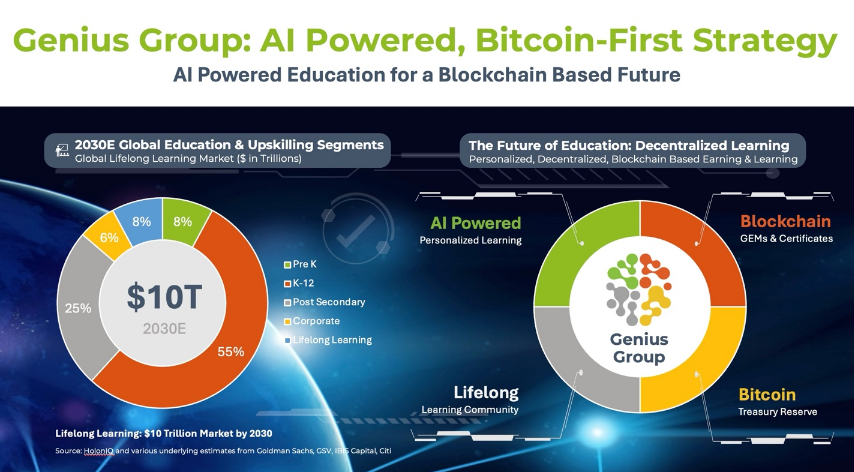

Founded in 2002, the Singapore-based Genius Group provides AI-driven educational technology spanning primary, secondary, and tertiary levels, as well as programs for entrepreneurs, businesses, and governments. The company became publicly listed on the NYSE American in 2022. Its recent Bitcoin-focused policy follows a board restructuring that brought in blockchain and Web3 experts.

“Genius Group is committed to preparing students for the future of exponential technologies, and we see Bitcoin as a primary store of value that will drive these advancements,” Power added.

Following in the footsteps of MicroStrategy, which now holds over 279,420 Bitcoin valued at approximately $24.5 billion with Bitcoin near $88,000, Genius Group joins other companies like Semler Scientific and Metaplanet, both of which have accumulated over 1,000 Bitcoin each this year.