CryptoQuant CEO Ki Young Ju predicts Bitcoin may close the year at $58,974, citing an overheated futures market as a potential reason for a year-end drop. However, another analyst holds a different view, suggesting that a significant pullback is unlikely.

On November 9, Ki Young Ju posted on social media platform X, forecasting that Bitcoin would end the year close to $59,000. He also invited users to share their predictions for the year-end price, offering a reward of 0.1 BTC to the closest estimate.

“I expected corrections as BTC futures market indicators showed signs of overheating, but we’re entering price discovery and the market is heating up even more,” Ki noted. “If a correction and consolidation happen, the bull run could be extended; however, a strong rally at year’s end might set the stage for a bear market in 2025,” he added. “Hope I’m wrong.”

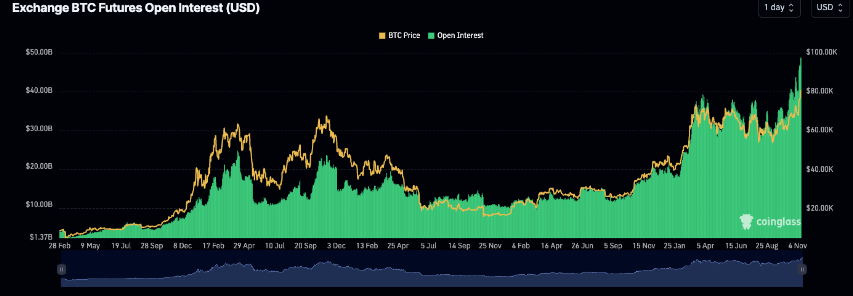

According to CoinGlass data, Bitcoin’s open interest — which measures the number of active positions in Bitcoin derivatives like futures and options — has reached nearly $50 billion, indicating unprecedented market activity.

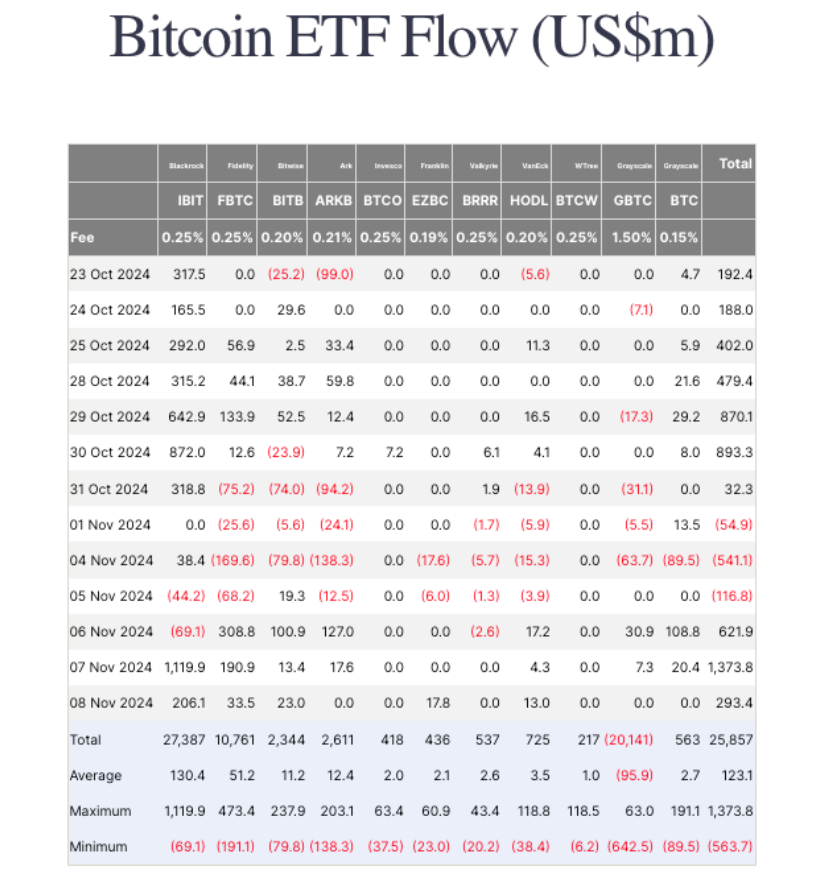

However, Collective Shift CEO Ben Simpson told Cointelegraph that while a pullback to $58,000 was technically possible, he believed it was “highly unlikely” before the end of the year. He explained, “With Trump’s candidacy, lowering interest rates, potential future quantitative easing, and consistent Bitcoin ETF volumes of around a billion dollars daily, more people are catching on.”

In the past week, Bitcoin surged by 17.3%, briefly reaching a new all-time high of $81,570 on November 10. Additionally, data from Farside Investors shows that a cohort of 11 spot Bitcoin ETFs saw a combined inflow of $1.6 billion last week, with November 7 marking the highest single-day inflow on record.

Simpson added, “With a limited supply asset like Bitcoin and growing demand, there’s only one way for prices to go. In previous cycles, 20-30% corrections were normal, but this time, the slow grind upwards is exciting to watch, as pullbacks have only been around 5-6% so far.”

He concluded, “The market structure looks very strong. While sudden dips are always possible, I believe the trend will continue upward.”