Despite a surge of investments from European investors, Bitcoin has been unable to regain the key psychological level of $70,000 since July.

Record European Inflows into US Bitcoin ETFs

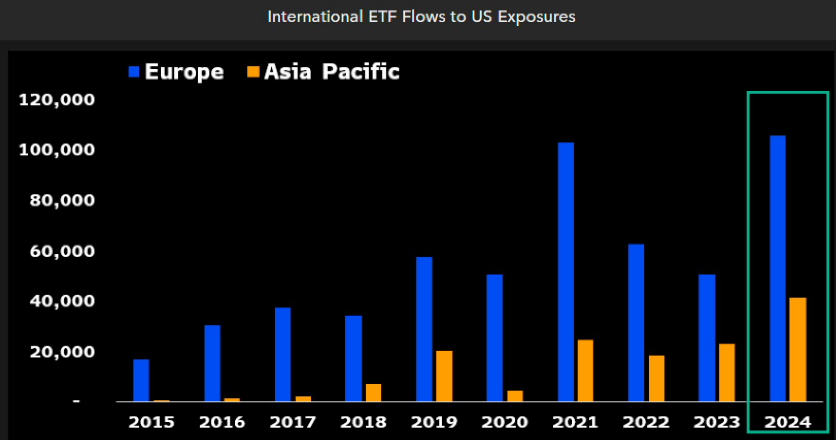

European investors have allocated a record-breaking $105 billion into spot Bitcoin exchange-traded funds (ETFs) in the United States so far this year. This marks an all-time high in inflows, as noted by Bloomberg senior ETF analyst Eric Balchunas in an October 21 post on social media platform X.

Balchunas wrote:

“European investors have funneled a record $105 billion YTD into US-focused ETFs. And why wouldn’t they? The S&P 500 ($SPY) is up 24%, while European markets lag behind with a 10% gain. Asia is also seeing record inflows.”

These rising ETF investments could be the catalyst that pushes Bitcoin toward a new all-time high, especially considering that US Bitcoin ETFs contributed roughly 75% of the capital that helped Bitcoin break above $50,000 in February 2024.

Bitcoin Price Still Stuck Below $70,000 Despite Record Inflows

Despite this record level of investment, data from Bitstamp reveals that Bitcoin has struggled to reclaim the $70,000 mark, last reached on July 29. While the ETF inflows have been significant, their effect on Bitcoin’s price seems to be delayed. According to Bitfinex analysts, it may take several days for these large capital inflows to translate into price movements in the spot market.

Analysts explained to Cointelegraph that the current order book indicates heavy selling pressure, suggesting that traders are using the recent ETF inflows as an opportunity to exit their positions. They noted, “Large ETF inflows often have a muted impact initially and may even lead to a downturn once the demand from spot buyers subsides.”

Bitcoin Hashrate Hits New Peak Amid ETF Records

In addition to the inflow records, Bitcoin’s network security has also reached new heights. On October 21, Bitcoin’s hashrate, which measures the total computational power securing the network, hit an all-time high. This growth in hashrate indicates an increasingly secure network but also results in higher mining costs.

Balchunas further highlighted that on October 17, US Bitcoin ETFs surpassed $20 billion in total net inflows — a milestone that took gold-based ETFs over five years to achieve.

Six-Day Streak of Positive ETF Inflows

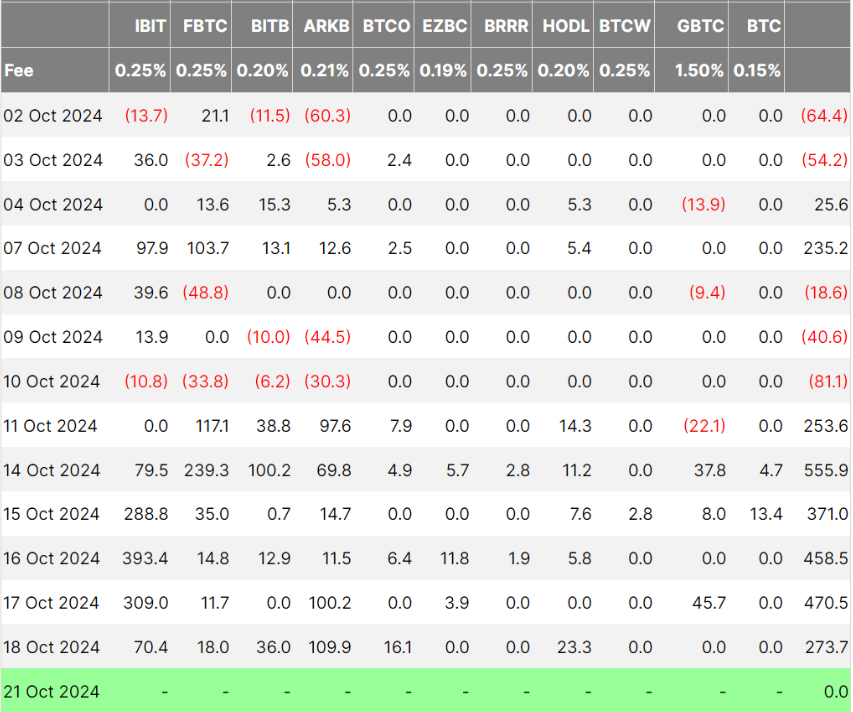

According to data from Farside Investors, Bitcoin ETFs have recorded six consecutive days of net positive inflows. On October 14 alone, US Bitcoin ETFs purchased a cumulative $555 million worth of Bitcoin, resulting in a 5% price surge from $62,450 to a daily high of $66,479.

Moreover, on-chain data from Dune Analytics reveals that Bitcoin ETFs collectively hold over $66.3 billion worth of Bitcoin, which accounts for approximately 4.9% of the current circulating supply. Despite these gains, Bitcoin remains stuck below the $69,500 mark, indicating that further upward momentum is still needed to break through resistance levels.